💖💗💝VAT Calculator Ireland 🥳🎉🎊

Manually calculating VAT can be a bit challenging because of varying rates on different goods and services. It is time consuming, and errors could lead to incorrect pricing or compliance issues. All of this can be easily avoided with a dedicated tool.

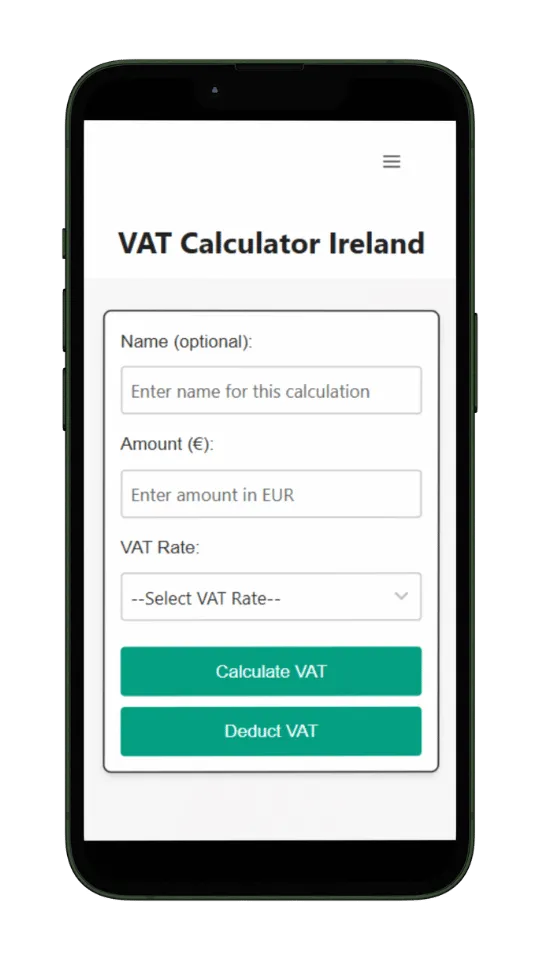

Introducing VAT Calculator Ireland! A free tool to add or deduct VAT from any amount by selecting the percentage of tax as regulated by Irish Tax Laws. It will give you an error free VAT amount, helpful for users needing to apply different VAT rates to different items.

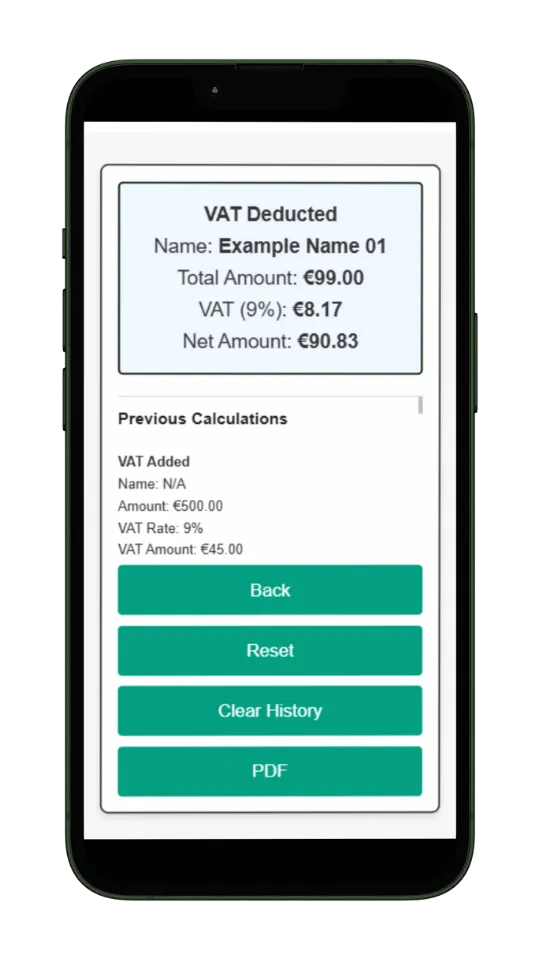

Previous Calculations

What is the VAT Calculator Ireland?

The VAT Calculator Ireland is all in one solution for VAT related calculations. It’s an online tool to help users make VAT calculations based on Ireland’s current guidelines. It’s useful in scenarios such as invoicing your clients, managing expenses or calculating final price before buying a service. This calculator will simplify the process and ensure productivity and saves valuable time.

Key Features

Learn How VAT is Calculated in Ireland: Value Added Tax Formula & Calculation

VAT Calculator Ireland calculations are compliant with Irish tax regulations. An essential tool for calculating and remembering VAT. It is helpful for managing your personal financial records and calculating VAT amounts. Check VRT Calculator.

What’s the VAT percentage for items?

0% (Exempt)

Essential goods and services. like exports, children’s clothing, books, medical supplies etc.

4.8% (Reduced)

Specialized Services mostly related to finance, insurance, and livestock

9% (Reduced)

Mostly for media, news and related publications

13.5% (Reduced)

Goods and Services socially beneficial like constructions, arts, catering, tourism etc.

23% (Standard)

Standard rates applied to all good and services that do not fit in above mentioned categories.

How to Use VAT Calculator Ireland?

Using VAT Calculator Ireland is a simple process, The tool is designed in a way to accommodate individuals and businesses alike. We have a step-by-step guide to make use of it.