💖💗💝VRT Calculator Ireland 🥳🎉🎊

Calculating Vehicle Registration Tax (VRT) has always been an intricate and time-consuming endeavor in Ireland, due to factors like CO2 emissions, engine size, fuel type and vehicle age influencing its final amount. Calculating these variables was once an uphill struggle but thanks to advances in digital tools like the VRT Calculator Ireland it now boasts an easier path.

VRT Calculator Ireland is an online tool created to streamline Vehicle Registration Tax calculations on registered or imported vehicles registered or imported into Ireland. Utilizing user data like CO2 emissions, engine size, fuel type and age it generates an accurate estimation of VRT payable, while its intuitive user interface and comprehensive features makes this an indispensable resource both individuals and businesses involved in automotive.

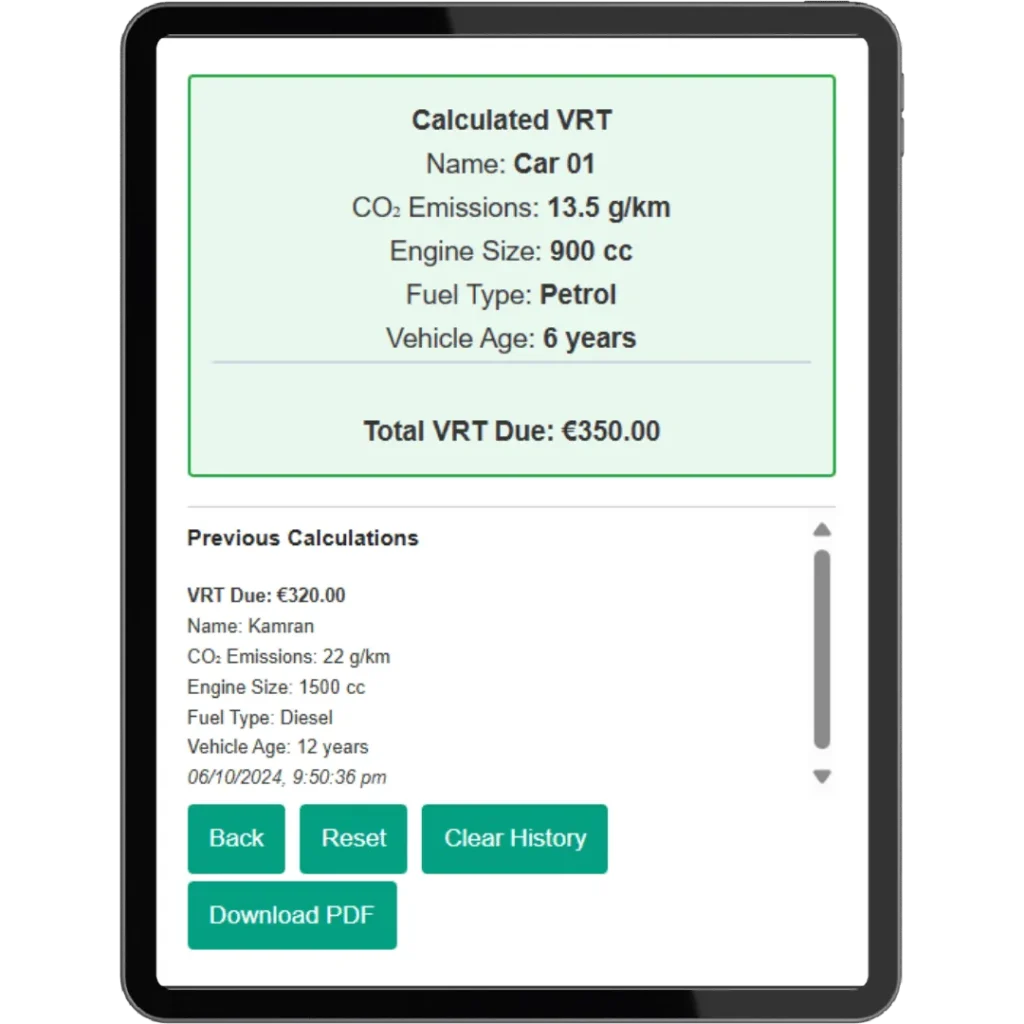

Previous Calculations

How VRT is Calculated in Ireland?

VRT calculation in Ireland depends upon several factors; these are:

Features of VRT Calculator Ireland

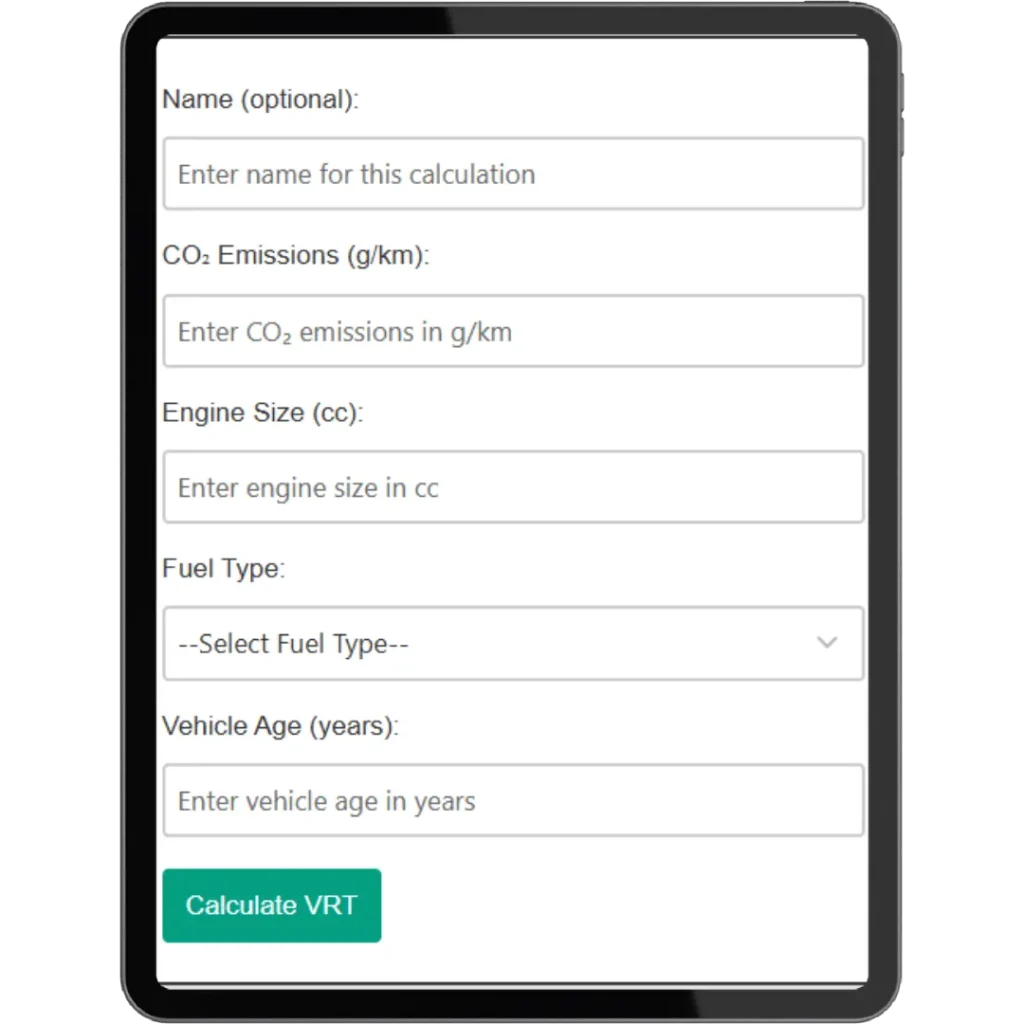

User-Friendly Interface

With clear labels and input validation, users can navigate their way easily through this calculator to ensure accurate data entry. Users enter specific details into input fields such as carbon dioxide emissions (in grams per kilometer), engine size in cubic centimeters, fuel type (petrol, diesel, electric hybrid etc.), and vehicle age in years.

Calculation Logic

To arrive at its total tax amount, this calculator applies predefined VRT rates and bands from its database, along with CO2 emissions adjustments, engine size modifications, fuel type types used and any discounts applicable based on vehicle age.

Results Display

Once calculated, VRT amounts and any factors impacting tax liability are prominently displayed upon calculation.

Save and Retrieve Calculations

VRT Calculator Ireland allows users to save and retrieve calculations locally for future reference, providing record keeping and comparison between vehicle options.

By streamlining the complex VRT calculation process this tool empowers users to make more informed decisions while complying with Irish tax regulations – whether purchasing new cars from overseas or importing used ones this resource can provide essential assistance when navigating all the intricacies of Vehicle Registration Taxation. Check VAT Calculator.

How Does It Work?

Use of the VRT Calculator Ireland is easy and involves only four simple steps. As part of these, enter Vehicle Details:

Step 1: Enter Vehicle Details

Step 2: Perform the Calculation

Step 3: View the Results

Additional Features

Tips for Optimal Use